Why Financial Spreading Automation Is Crucial for Fast Decision Making

This blog explores why financial spreading automation is essential for speeding up industry decision-making processes. We will dive into how automation enhances accuracy, streamlines workflows, and enables organizations to make better, faster decisions, all while improving overall efficiency.

Does the manual entry and processing of financial data take up too much time for your team? Nowadays in the business world, quick and informed decision-making is essential. Financial analysts, lenders, and investors rely on accurate economic data to assess risk, identify trends, and make the right calls. But manual processes can slow things down, leading to missed opportunities and delayed decisions.

This blog explores why financial spreading automation is essential for speeding up industry decision-making processes. We will dive into how automation enhances accuracy, streamlines workflows, and enables organizations to make better, faster decisions, all while improving overall efficiency.

Speed: The First Key Advantage of Financial Spreading Automation

Time is money, especially in the world of finance. Processing and entering data by hand takes a lot of time and is prone to human mistakes. Financial spreading automation solves these problems by significantly speeding up the entire process. Whether your team is analyzing a single loan application or assessing the economic health of a portfolio, automation can drastically reduce the time it takes to prepare financial statements.

Large amounts of financial data can be processed in minutes rather than hours with automated methods. This speed enhances productivity and helps businesses make decisions faster. For example, lenders can quickly assess the financial viability of borrowers, while investors can evaluate potential acquisition targets without the lengthy delays associated with manual data gathering.

Enhanced Accuracy for Better Decision Making

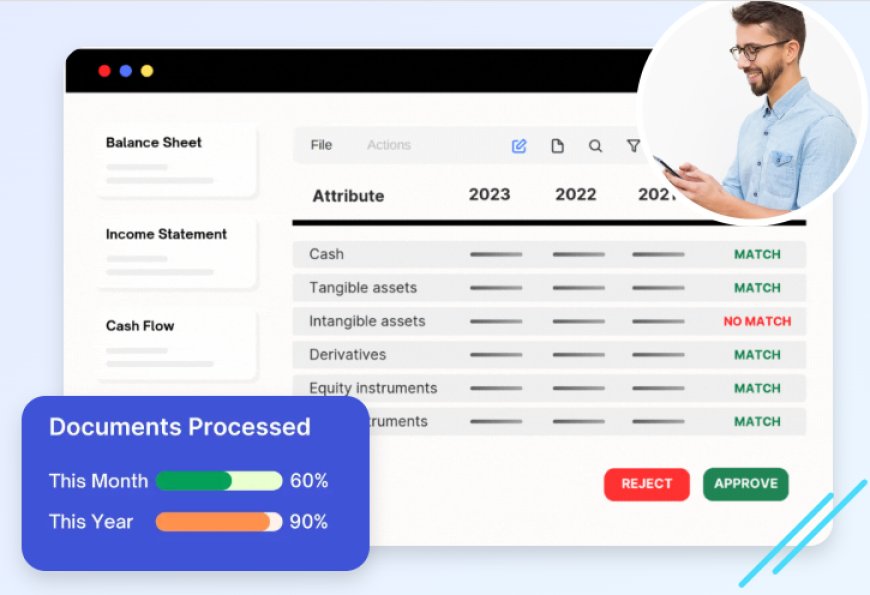

Manual entry introduces a risk of errors, whether due to incorrectly classifying data or missing key metrics. These minor errors can compound and affect decision-making, potentially leading to costly mistakes. Financial spreading automation drastically reduces these errors by standardizing the extraction and classification of economic data. Automated systems use algorithms and predefined templates to capture all relevant data points accurately.

This accuracy is crucial when evaluating financial health. Lenders rely on precise data to assess credit risk, while investors need trustworthy figures for portfolio management and valuation. By implementing financial spreading automation, financial professionals can make decisions based on consistent, reliable data, which is critical for minimizing risk and maximizing opportunities.

Streamlining Workflows and Boosting Productivity

In many organizations, financial data must pass through several departments for approval or analysis. Each department typically re-enters or manipulates the data, leading to inefficiencies, miscommunications, and delays. With financial spreading automation, all teams work from the same data source, ensuring consistency across the board. Automated systems also help eliminate redundant tasks, allowing teams to focus on higher-level analysis and strategic decision-making.

For example, an automated system can pull data directly from a companys financial reports, automatically categorize it, and feed it into the appropriate models or reports. This eliminates the need for manual updates, reduces the chance of discrepancies, and allows teams to move forward without delays.

Real-Time Insights for Informed Decisions

Making real-time decisions is one of the most significant advantages of financial spreading automation. When economic data is updated in real time and presented in a standardized format, it enables quicker analysis and decision-making. For example, real-time financial data can be automatically processed and assessed if a lending institution considers a loan, allowing for faster approval processes.

This capability is especially valuable in dynamic markets, where acting quickly can mean the difference between gaining a competitive edge and falling behind. Businesses can quickly access the most recent financial data when automated systems are in place, which enables them to respond to changes in the market and make data-driven decisions with confidence.

Scalability and Flexibility in Decision Making

As your business grows, so does the volume of financial data you need to manage. Financial spreading automation scales with your organizations needs, making it easy to process large amounts of financial data without adding to your teams workload. Automated systems can handle increasingly complex financial data from multiple sources without sacrificing speed or accuracy.

For businesses introducing new goods, entering new markets, or purchasing other businesses, this scalability is extremely advantageous. Automated financial spreading systems can quickly adapt to these changes and provide the data to evaluate new opportunities or risks.

Enhancing Compliance and Risk Management

For highly regulated sectors like banking and finance, compliance is paramount. Automated financial systems lower the risk of non-compliance by ensuring that all financial data is processed in accordance with regulatory regulations. Organizations may keep track of and record all data-related actions with financial spreading automation, generating a compliance audit trail.

Automated systems can also identify inconsistencies or flaws in financial reporting, warning decision-makers of possible dangers before they become concerns. By taking a proactive approach to risk management, companies can reduce financial risks prior to making important choices.

Conclusion

In the fast-moving financial environment, financial spreading automation is no longer just a luxuryits a necessity. Automating the process of spreading financials enhances accuracy, speeds up workflows, and allows businesses to make quicker, more informed decisions. By reducing manual effort and streamlining data management, automation enables financial professionals to focus on analysis, not data entry.

If your team still relies on manual processes to handle financial data, its time to consider automation. Embrace the power of financial spreading automation to drive smarter, faster decision-making, giving your organization a competitive edge in the market.