The Real ROI of Outsourcing Accounts Payable Services

In todays fast-paced business world, companies are under increasing pressure to do more with less. Finance teams, especially, are being pushed to reduce costs, improve efficiency, and contribute to strategic growth. One area where businesses are unlocking significant value is outsourcing accounts payable services.

But whats the real return on investment (ROI) of outsourcing accounts payable? Is it just about cutting costs or is there more to it?

Lets break down the true impact of AP outsourcing and why its becoming a strategic move for forward-thinking companies in 2025.

What Does It Mean to Outsource Accounts Payable?

Outsourcing accounts payable (AP) involves partnering with a third-party service provider to handle tasks like:

-

Invoice receipt and processing

-

PO matching

-

Vendor payments

-

Reconciliation

-

Compliance and reporting

Instead of maintaining a large in-house AP team or relying on outdated manual processes, businesses gain access to streamlined systems, automation tools, and experienced professionals at a fraction of the cost.

The Real ROI: Where the Value Adds Up

When evaluating ROI, most people first think of cost savings. While thats important, the true value of outsourcing AP extends far beyond just cutting overhead.

Here are the key areas where businesses see measurable ROI:

1. Cost Efficiency and Labor Savings

Lets start with the obvious saving money.

Hiring and training an internal AP team can be expensive. Salaries, benefits, office space, and software subscriptions add up quickly. When you outsource, you eliminate many of these fixed costs and shift to a scalable pricing model.

Most businesses report up to 4060% cost reduction in AP operations after outsourcing.

2. Faster Invoice Processing

Speed matters when it comes to managing payments. Delays can lead to late fees, strained vendor relationships, and missed early payment discounts.

Outsourcing partners use automation and dedicated workflows that ensure invoices are processed faster and more accurately. In many cases, companies can reduce invoice processing time from weeks to just a few days.

Faster turnaround = better cash flow visibility and control.

3. Improved Accuracy and Fewer Errors

Manual data entry is one of the biggest sources of error in accounts payable. A wrong digit or misplaced decimal can throw your entire ledger off not to mention damage vendor trust.

With outsourced AP services, automation tools and standardized processes ensure accuracy levels of over 99%, significantly reducing costly errors and rework.

4. Stronger Vendor Relationships

Vendors are the backbone of your supply chain. When theyre paid accurately and on time, it builds trust and reliability.

An efficient AP outsourcing partner helps maintain timely communication and ensures that vendor payments go out without delays. This helps you negotiate better terms and strengthen partnerships an often overlooked but strategically important ROI.

5. Enhanced Compliance and Audit Readiness

Regulatory requirements around financial reporting and data security are only getting more complex.

Outsourcing providers typically maintain strict compliance with industry standards (such as SOC 2, GDPR, or SOX), helping you reduce risk. Plus, with organized digital records and real-time reporting, youre always audit-ready.

Thats not just convenience its risk mitigation that protects your business reputation and avoids potential penalties.

6. Access to Advanced Technology Without Extra Investment

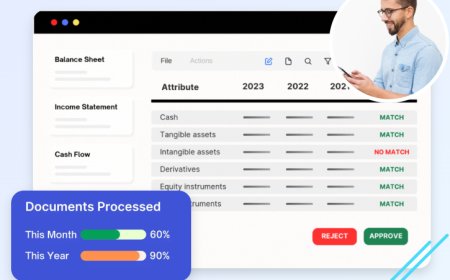

Accounts payable automation tools, AI-driven invoice matching, cloud-based workflows these technologies improve efficiency but can be expensive to implement internally.

When you outsource, you benefit from best-in-class AP technology without investing in infrastructure or ongoing upgrades. Its like renting a fully equipped finance engine, ready to go.

This results in tech-enabled ROI better results, with minimal tech spend.

7. Scalability and Flexibility

Whether you're processing 500 invoices a month or 5,000, outsourcing gives you the flexibility to scale without hiring new staff or overhauling systems.

During peak seasons, mergers, or periods of fast growth, your AP operations wont become a bottleneck. That scalability is a long-term asset that helps businesses grow smoothly.

How to Measure the ROI of AP Outsourcing

So how do you track the return?

Here are some KPIs that companies use to measure the ROI of outsourcing accounts payable services:

-

Cost per invoice processed (before vs after outsourcing)

-

Time to process an invoice

-

Error rate in invoice data entry

-

Percentage of invoices paid on time

-

Early payment discounts captured

-

Internal resource hours saved

By benchmarking these metrics before and after outsourcing, businesses often find ROI results that go far beyond initial expectations.

Real-World Example

Lets say a mid-sized company was spending ?450 per invoice on internal processing. After outsourcing, that cost dropped to ?180. Processing time was reduced from 10 days to 3. In just 6 months, the company saved over ?10 lakhs, improved payment accuracy, and reallocated finance staff to more strategic roles.

Thats not just ROI thats business transformation.

Final Thoughts: A Strategic Investment, Not Just a Cost Cut

Outsourcing accounts payable services isnt just about saving a few rupees its about turning your finance function into a smart, efficient, growth-ready machine.

With benefits like reduced costs, faster processing, better vendor relationships, improved compliance, and access to top-tier tech, the real ROI is both tangible and strategic.

In 2025, businesses that continue to handle AP manually will struggle to keep up. Those that outsource will move faster, operate leaner, and grow stronger.

So if you're still on the fence, its time to ask: Can you really afford not to outsource your accounts payable?