Why IRD-Verified Billing Software Is a Must for Nepali SMEs?

Discover why IRD-verified billing software is essential for Nepali SMEs—from tax compliance to improved accuracy and real-time insights.

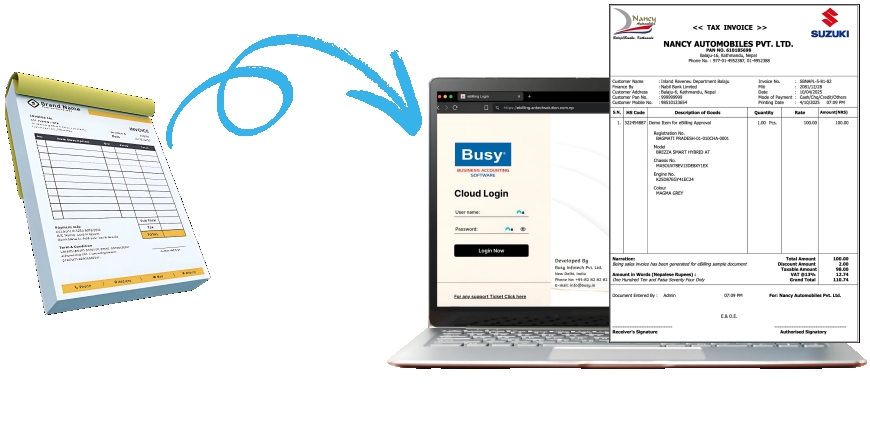

Running a small or medium-sized business in Nepal comes with its own set of challengesfrom managing inventory and sales to dealing with taxation and compliance. One area thats often overlookedbut critically importantis billing. With the rise of digital tax systems in Nepal, the Inland Revenue Department (IRD) now requires businesses to use IRD-verified billing software. But what does this really mean for your business? And why is it so important?

Lets break it down.

What Is IRD-Verified Billing Software?

IRD-verified billing software is a type of invoicing system that meets the technical standards and compliance requirements set by Nepals Inland Revenue Department. These systems are approved to generate tax invoices that are automatically recorded in a format accepted by the IRD. Most of these platforms are equipped with VAT billing, real-time reporting, and audit-ready features.

Using such software is legally mandatory for VAT-registered businesses in Nepaland its becoming a smart move even for smaller ones.

1. Stay Legally Compliant

If your business is VAT-registered or exceeds the annual revenue threshold set by the IRD, youre required to use approved billing software. Failure to comply can result in penalties, fines, or even a temporary shutdown of operations.

By adopting IRD-verified software, you ensure that your billing practices follow government standardsgiving you peace of mind and protecting your business from legal risk.

2. Streamline Your Tax Filing Process

Lets face it: tax time can be a nightmare for many SME owners. Manually compiling invoices, calculating VAT, and cross-checking numbers with your accountant takes time and opens the door to errors.

With IRD-compliant billing software, your sales records are automatically organized and ready for submission. Many systems also offer VAT summaries and export features that simplify tax filing dramaticallysaving you hours each month.

3. Build Trust with Customers and Partners

Using official billing software reflects professionalism and transparency. When your invoices are properly formatted and tax-compliant, clients are more likely to trust your business practices.

This is especially important if you plan to work with larger clients, suppliers, or even government agencies, where clean billing is a requirement.

4. Improve Accuracy and Reduce Fraud

Manual billing systems or outdated software are prone to human error and data manipulation. IRD-approved software helps prevent:

-

Duplicate or fake invoices

-

Incorrect VAT calculations

-

Unauthorized changes to billing history

The system maintains a clear audit trail, reducing the chances of mistakes and fraudand making audits much less stressful.

5. Get Real-Time Business Insights

Most modern IRD-verified billing platforms go beyond invoicing. They offer real-time data on:

-

Daily and monthly sales

-

Tax liabilities

-

Top-selling products

-

Customer history

This data helps you make smarter decisions about inventory, pricing, promotions, and cash flow.

6. Be Ready for Nepals Digital Future

Nepal is moving quickly toward digitizing its tax and financial systems. Businesses that adapt early will be better positioned to grow, attract funding, and stay ahead of compliance requirements.

By choosing the right billing software now, youre not just avoiding penaltiesyoure future-proofing your business.

Who Should Use It?

-

Retail stores & wholesalers issuing VAT invoices

-

Service providers needing official tax-compliant billing

-

Online businesses who want a clean digital record

-

Distributors & traders managing large numbers of transactions

Even if your business isnt required yet by law, adopting such software early helps you grow confidently and stay organized from day one.

Final Thoughts

For Nepali SMEs, using IRD verified billing software isnt just a legal formalityits a business advantage. It helps you operate more professionally, reduces risk, improves efficiency, and ensures compliance with national tax laws.

If youre still billing with Word templates or unverified tools, now is the time to make the switch. A small investment in the right software today could save you from massive headaches tomorrow.