Green Living Room Cleaning Drives Premium Market Segment

Environmentally friendly products and sustainable service models are reshaping consumer expectations in the living room cleaning industry.

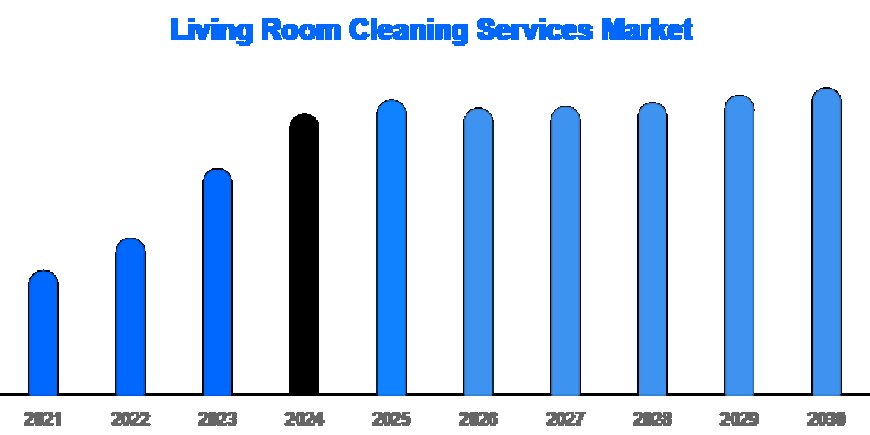

Global Living Room Cleaning Services Market Set to Reach USD 21.5 Billion by 2030 Amid Health Awareness, Urbanization, and App-Based Convenience

| Deep Market Insights

The global living room cleaning services market, valued at USD 12.7 billion in 2024, is projected to reach USD 21.5 billion by 2030, growing at a CAGR of 9.1% from 2025 to 2030, according to a new industry report by Deep Market Insights.

Driven by post-pandemic hygiene awareness, the rise of dual-income households, and growing reliance on app-based on-demand cleaning platforms, living room cleaning services are seeing rapid adoption across both developed and emerging economies. Demand for recurring, modular, and eco-conscious service options is reshaping the home care services landscape.

Key Highlights

-

Market Size: USD 12.7 billion (2024) ? USD 21.5 billion (2030)

-

Top Segment: Standard living room cleaning led with USD 5.3 billion in 2024

-

Frequency Preference: Recurring services held a dominant 57% market share in 2024

-

Primary End-User: Single-family homes represented 62% of demand

-

Top Region: North America led with USD 4.8 billion market size in 2024

-

Fastest-Growing Region: Asia-Pacific at a CAGR of 11.5% through 2030

Market Dynamics

Growth Drivers

-

Post-Pandemic Hygiene Awareness: A lasting shift in consumer focus on cleanliness and indoor air quality has increased demand for professional services targeting microbial contamination, dust mites, and allergens in shared spaces.

-

Urbanization & Dual-Income Lifestyles: With more urban dwellers and working couples, the need for outsourced home care solutions has surgedespecially in metros and suburban complexes.

-

Digital Booking & App-Based Services: Platforms like Urban Company, Handy, and TaskRabbit are scaling fast, offering modular booking, same-day appointments, and bundled services for flexibility and ease.

Market Restraints

-

Labour Shortages: High turnover and low wages in the cleaning sector impact service quality and scalability, particularly in Asia and Latin America.

-

Regulatory Challenges: Informal gig work, lack of labour protections, and ambiguous liability laws hinder workforce standardization and customer trust.

Emerging Opportunities

-

Tier-2 Cities & Suburban Growth: Expanding middle classes and limited access to domestic help in suburban areas are fueling localized service expansion strategies.

-

Smart Cleaning Technologies: Voice-activated scheduling, AI-powered stain detection, and IoT-based optimization tools are driving higher efficiency and customer satisfaction.

-

Green Cleaning Demand: Rising consumer awareness is boosting adoption of biodegradable, non-toxic cleaning agents and enabling premium eco-service offerings.

Regional Analysis

North America

-

Market Size: USD 4.8 billion (2024) | CAGR: 8.5%

High disposable incomes, aging demographics, and green-conscious consumers are driving strong growth. Major cities like New York and Toronto show high penetration of recurring app-based services.

Europe

-

Market Size: USD 3.6 billion (2024) | CAGR: 7.8%

Driven by dual-income households and EU environmental mandates, the region emphasizes allergen control and low-emission service options.

Asia Pacific

-

Market Size: USD 2.4 billion (2024) | CAGR: 11.5%

The fastest-growing region, led by India, China, and Southeast Asia. App-first platforms and tech-savvy consumers dominate the demand landscape.

Latin America

-

Market Size: USD 1.0 billion (2024) | CAGR: 9.3%

Urbanization, female workforce growth, and gig-economy startups are fueling expansion in cities like So Paulo and Mexico City.

Middle East & Africa

-

Market Size: USD 0.9 billion (2024) | CAGR: 8.6%

Luxury housing, expat communities, and smart city projects in the UAE and Saudi Arabia are key demand drivers, often bundled with air purification services.

Company Market Share & Leadership

The market is moderately fragmented, with companies adopting hybrid models that blend local workforce deployment with tech-enabled customer experiences.

Key Players:

-

Urban Company: Asias dominant player, expanding across Southeast Asia with in-app hygiene bundles and multilingual app support

-

Merry Maids: U.S.-based, recently partnered with eco-brand Seventh Generation for green service bundles

-

Handy: Offers rapid booking via mobile and focus on urban millennial households

-

TaskRabbit: Expanding into Latin America with modular cleaning bundles

-

Molly Maid: Focused on North American suburban families, offering recurring and personalized packages

Recent Developments

-

March 2025: Urban Company raised $150M in Series F funding led by Temasek to scale operations across Southeast Asia and upgrade its AI-based CRM platform.

-

September 2024: TaskRabbit launched in Mexico City with hyper-localized cleaning bundles and regional partnerships to navigate language and logistics barriers.

-

Q2 2024: Merry Maids launched exclusive eco-cleaning services in North America in collaboration with Seventh Generation.

Read report here in detail : https://deepmarketinsights.com/report/living-room-cleaning-services-market-research-report