Forex Funding for Professional Traders: Unlocking Capital to Maximize Success

forex funding for professional traders

In the competitive world of forex trading, capital is the fuel that drives performance. While skill, strategy, and discipline are critical elements, many skilled traders face the barrier of limited capital. This is where forex funding for professional traders becomes a game-changer. It opens doors for seasoned individuals to access large trading accounts without risking their own funds, enabling them to scale their operations and focus entirely on performance.

Understanding Forex Funding

Forex funding refers to financial backing provided by proprietary trading firms, also known as "prop firms." These firms evaluate a trader's performance and, once they pass certain criteria (such as demo challenges or trading assessments), allocate real capital for live trading. In return, the trader keeps a percentage of the profits, while the firm assumes most or all of the risk.

For professional traders, this model provides the chance to trade large sumsoften ranging from $10,000 to $1,000,000 or morewithout putting personal savings at risk. It also fosters accountability and discipline, as traders must follow risk management rules set by the funding firm.

Why Professional Traders Seek Funding

Professional forex traders often reach a point where their strategy is proven, but their personal capital limits the growth of their returns. Here are a few reasons why they opt for forex funding:

1. Access to Larger Capital Pools: Trading with more capital amplifies profit potential. A skilled trader with a sound strategy can significantly boost returns when capital is not a limiting factor.

2. Risk Mitigation: Trading with a funded account means losses dont come from the traders pocket. The firm absorbs the risk, allowing traders to execute their strategy without emotional strain.

3. Scalability: Funded accounts often come with scaling plans. If a trader performs consistently, the firm increases the capital allocation, which means more opportunities without additional risk to the trader.

4. Professional Environment: Many funding programs offer tools, mentorship, and community accesselements that help professional traders enhance their craft and stay aligned with industry standards.

How Forex Funding Works

To obtain forex funding, professional traders typically go through the following process:

Assessment Phase: This is usually a demo trading challenge where traders must meet specific profit targets within a given time frame while adhering to drawdown and risk parameters. For example, a trader may be required to earn a 10% return without exceeding a 5% daily loss.

Verification Phase: After passing the initial challenge, the trader may undergo a second evaluation with slightly different or more lenient rules to confirm consistency.

Funding Phase: Once the trader passes the verification, they receive a live funded account. Depending on the firm, traders might start with $10,000, $25,000, $100,000, or more.

Profit Sharing: Most prop firms operate on a profit split model. Common arrangements are 70/30 or 80/20 in favor of the trader. Some top-tier firms even offer 90/10 profit splits for high performers.

Traits of a Successful Funded Trader

Discipline: Funded traders must follow strict risk management guidelines. Even a single violation can lead to account termination.

Consistency: Prop firms look for traders who can generate stable, long-term profits, not those who chase high-risk, high-reward strategies.

Emotional Control: Trading large accounts can be emotionally taxing. Professional traders must stay detached from losses and wins, focusing solely on process.

Strategy Proficiency: Having a proven and back-tested trading system is crucial. Firms prefer traders who follow a clear methodology and adapt to changing market conditions.

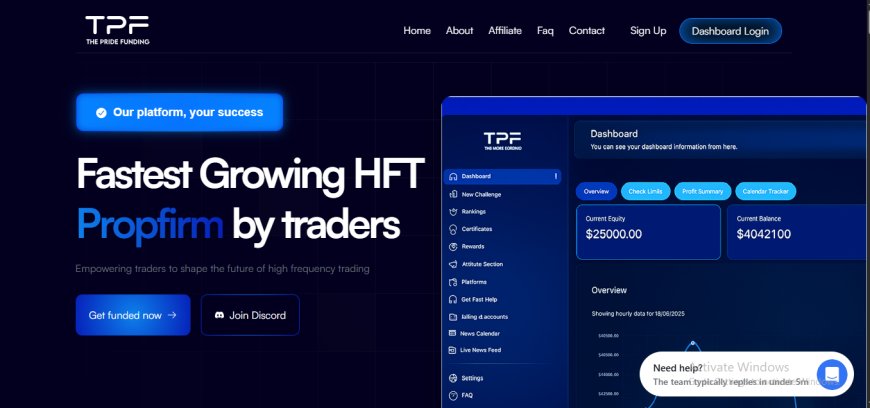

Leading Forex Funding Programs

The rise in popularity of prop firms has led to a surge in options available to traders. While each program has unique features, the best ones share several qualities: transparency, favorable profit splits, realistic trading rules, and robust support.

Some well-known names in the forex funding for professional traders industry include:

-

FTMO

-

MyForexFunds

-

The5%ers

-

FundedNext

-

Fidelcrest

-

True Forex Funds

Before committing to any funding program, professional traders should thoroughly evaluate the firms terms, customer reviews, payout history, and regulatory standing.

Common Challenges and Pitfalls

Even seasoned professionals can face difficulties in a funded trading setup. Some challenges include:

Strict Rules: Even minor deviations from the firms rules can result in loss of the funded account. This includes issues like over-leveraging or holding trades over the weekend.

Psychological Pressure: Knowing that account violations can result in termination often increases pressure. Traders must balance confidence with caution.

Unrealistic Expectations: Some traders aim to pass evaluations quickly without understanding the firms drawdown or risk requirements, leading to early failure.

Platform and Execution Differences: Not all platforms used by funding firms offer the same execution speed or trading conditions as retail brokers. Adapting to these can be a learning curve.

Tips for Succeeding with Forex Funding

To maximize the opportunity provided by forex funding, professional traders should:

Start Slow: In the evaluation phase, prioritize passing rather than maximizing profits. Follow the rules and focus on consistency.

Use a Proven Strategy: Avoid experimenting with new methods during evaluation. Stick to what has been tested and proven to work.

Track Performance: Use trading journals and performance analytics to monitor progress, identify mistakes, and refine strategies.

Stay Updated: Stay informed about market events, economic indicators, and news releases. A professional trader should always be prepared for volatility.

Choose the Right Firm: Not all funding companies are created equal. Evaluate the firms conditions, credibility, and support options.

The Future of Forex Funding

With technological advancements and global accessibility, the forex funding landscape is rapidly evolving. Were seeing increased competition among firms to attract top traders, which leads to better conditions, higher profit splits, and more transparent models.

Artificial Intelligence is also making its way into risk assessment and trader analytics, allowing firms to better identify high-potential traders and personalize support. Additionally, decentralized finance (DeFi) and blockchain may soon disrupt the traditional forex funding model, offering new models of capital access.

Conclusion

Forex funding for professional traders is not just a trendits a transformative opportunity that allows skilled traders to access large pools of capital, mitigate personal financial risk, and grow their careers in a meaningful way. Whether youre a trader looking to scale up or a professional wanting to break into institutional-style trading, the funded account model offers the structure, resources, and motivation to thrive.