Tax on Repatriation of Funds from India: A Guide for NRIs

For Non-Resident Indians (NRIs), managing financial assets in India often involves sending money back to their country of residence a process commonly known asrepatriation of funds from India. Whether it is income from property sales, investments, inheritance, or interest earned on bank accounts, transferring money abroad requires a clear understanding of the taxation laws and RBI regulations.

In this comprehensive blog, we will break down the tax implications, the procedural requirements, and how services likeRepatriation Services for NRIsandWealth Transfer Advisory in Indiacan simplify the process.

What is Repatriation of Funds?

Repatriation of funds refers to the process of transferring money from India to a foreign country, typically by NRIs or foreign nationals. These funds can be in the form of:

- Sale proceeds from property or investments

- Rental income

- Inherited assets

- Dividends or interest earned in India

- Gifts or funds held in NRO (Non-Resident Ordinary) accounts

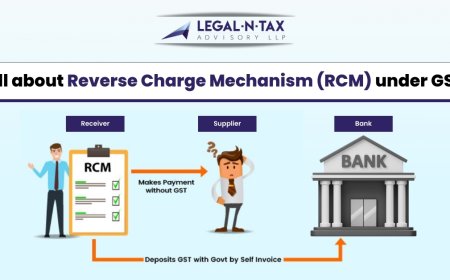

Is There a Tax on Repatriation?

The act ofrepatriating money from Indiais not taxable by itself. However, thesourceof the funds must be tax-compliant. This means that the income being repatriated must have already been taxed in India as per the Indian Income Tax Act. Lets look at a few common scenarios:

1. Income from Property Sale

If an NRI sells property in India, capital gains tax is applicable. The buyer is required to deduct TDS (Tax Deducted at Source) at 20% (plus surcharge and cess) on long-term capital gains or 30% on short-term gains.

2. Interest from NRO Accounts

Interest earned on NRO accounts is taxable at 30% (plus applicable cess and surcharge). This income must be declared and tax paid before funds are repatriated.

3. Inheritance or Gift

If the inherited or gifted money is from a relative as defined under Indian law, there is usually no tax. But any income earned from such funds will be taxable before repatriation.

TDS and the Importance of the TDS Exemption Certificate for NRIs

One major hurdle in repatriation is TDS. Many NRIs face situations where excess tax is deducted at source, which can be avoided by applying for aTDS Exemption Certificate for NRI(also known as a Lower/Nil Deduction Certificate) under Section 197 of the Income Tax Act.

This certificate authorizes the payer (e.g., buyer of property, tenant, etc.) to deduct tax at a lower rate or not at all, depending on the NRIs total tax liability. Applying for this certificate is crucial for reducing cash outflows and ensuring a smoother repatriation.

RBI Regulations for Repatriation

The Reserve Bank of India (RBI) allows NRIs to repatriate up toUSD 1 million per financial year(AprilMarch) from NRO accounts, provided proper documentation and tax compliance is in place. The key documents required include:

- Form 15CA and Form 15CB (for tax declaration and certification by a Chartered Accountant)

- Tax payment proofs

- PAN card

- Passport and visa copies

- Property documents or source of funds

Expert Repatriation Services for NRIs

Given the complexity of Indian tax and banking rules, engaging professionals offeringRepatriation Services for NRIscan be highly beneficial. These experts help with:

- Income tax filing and TDS computation

- Obtaining TDS exemption certificates

- Preparing Form 15CA/15CB

- Liaising with banks and RBI

- Ensuring legal compliance under FEMA (Foreign Exchange Management Act)

If you're unsure how to initiate repatriation or need help navigating the paperwork, it's best to consult a firm that specializes inrepatriating money from India.

Wealth Transfer Advisory in India

When it comes to transferring large sums of money either from inheritances, real estate sales, or business exits strategic planning is vital. This is whereWealth Transfer Advisory in Indiacomes in.

Wealth transfer advisors help NRIs manage:

- Cross-border inheritance planning

- Estate tax implications in both countries

- Gifting strategies and tax optimization

- Succession planning and trust formation

- RBI permissions for large remittances

Such services are especially useful for high-net-worth individuals who want to ensure that their wealth transition is smooth, compliant, and tax-efficient.

Step-by-Step Guide to Repatriating Funds from India

Heres a quick checklist for NRIs looking to repatriate funds:

- Determine the source of income Ensure its compliant with Indian tax laws.

- Pay applicable taxes File income tax returns and pay taxes if needed.

- Apply for TDS Exemption Certificate (if required) Avoid excess deductions.

- Prepare documentation Collect PAN, Form 15CA/CB, proof of source, etc.

- Work with a professional Engage a CA or consultant for accurate compliance.

- Remit through authorized channels Use banks authorized under FEMA.

Common Mistakes to Avoid

- Ignoring TDS rules: Many NRIs repatriate funds without applying for TDS exemption, leading to huge deductions.

- Incomplete documentation: Missing forms like 15CA/15CB can delay or halt the process.

- Not consulting experts: DIY approaches may seem easy but often result in tax notices or penalties.

- Repatriating from unauthorized accounts: Only certain types of income from NRO accounts are eligible for repatriation.

Final Thoughts

Repatriating money from India as an NRI involves more than just transferring funds. It requires a deep understanding of Indian tax laws, FEMA regulations, and RBI procedures. Fortunately, with the help ofRepatriation Services for NRIs, expertWealth Transfer Advisory in India, and a trusted tax consultant, you can make the process hassle-free and legally sound.

From applying for aTDS Exemption Certificate for NRIto ensuring timely documentation forrepatriation of funds from India by NRI, every step matters and professional support can make all the difference.

Contact Us

For reliable, expert assistance in repatriating your funds from India, tax planning, and wealth advisory, get in touch with us:

Springhouse

639A, B-1 Block, Janakpuri,

New Delhi-110058, India

?+91-9711323533

?rahul@rpareva.com