Tax Treaty Advisory – Expert DTAA Guidance by Legal-N-Tax Advisory LLP

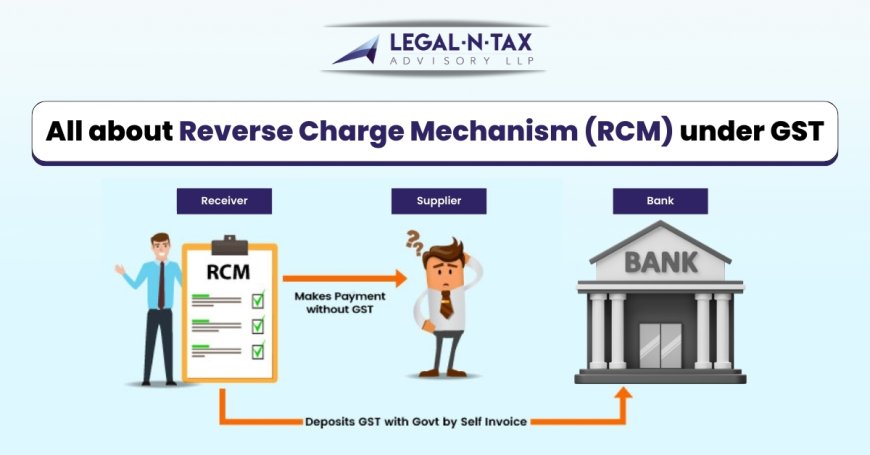

In todays global economy, cross-border investments, international business transactions, and overseas employment are increasingly common. However, with international income comes international tax obligations. Without proper guidance, individuals and businesses may find themselves taxed twice on the same income in different countries.

This is whereTax Treaty Advisorybecomes crucial. AtLegal-N-Tax Advisory LLP, we offer specialized support to help clients navigate the complexities ofDouble Taxation Avoidance Agreements (DTAAs), ensuring tax efficiency and compliance with international norms.

What is Tax Treaty Advisory?

Tax Treaty Advisoryinvolves expert guidance on how to apply tax treaties between two countries to minimize or eliminate the risk of double taxation. These treaties are negotiated between countries to provide tax relief and facilitate international trade and investment.

Proper tax treaty advisory allows taxpayers to:

- Avoid double taxation on income earned abroad

- Understand tax residency requirements

- Access treaty benefits through documentation like theTax Residency Certificate

- Ensure compliance with reporting obligations under Indian and foreign tax laws

Legal-N-Tax Advisory LLP offers tailored advisory services for individuals, NRIs, expats, multinational companies, and startups involved in cross-border activities.

Why DTAAs Matter for Cross-Border Taxation

Double Taxation Avoidance Agreements (DTAAs)are key tools for preventing the same income from being taxed in both the source country and the resident country. India has signed tax treaties with over 90 countries including the USA, UK, Canada, UAE, Singapore, and many others.

Applying the right DTAA provisions requires deep understanding of:

- Treaty interpretation

- Domestic tax laws

- Source vs. residence taxation

- Permanent establishment rules

- Article-by-article analysis of treaties

With the help of expertDTAA consultancy in India, businesses and individuals can optimize their global tax liability while staying fully compliant.

Tax Residency Certificate A Critical Requirement

To claim benefits under a DTAA, one must produce a validTax Residency Certificate (TRC). This certificate is issued by the tax authorities of the country where the taxpayer is a resident and is mandatory to avail reduced rates or exemptions on foreign income.

AtLegal-N-Tax Advisory LLP, we assist clients in:

- Obtaining TRC from Indian or foreign authorities

- Drafting and submitting supporting documents

- Ensuring TRC meets treaty requirements for the relevant financial year

- Avoiding rejection of DTAA claims due to procedural lapses

Our team ofInternational Tax Consultants in Indiaensures that every stepfrom TRC application to income tax return filingis handled seamlessly.

Our Foreign Tax Consultancy Services

Global taxation requires a holistic approach. At Legal-N-Tax Advisory LLP, we provide end-to-endforeign tax consultancyservices covering:

- Interpretation of foreign and Indian tax laws

- Withholding tax advisory for outbound/inbound remittances

- Cross-border structuring and tax optimization

- Advisory for NRIs, foreign nationals, and foreign companies in India

- FATCA & CRS compliance

- Income characterization under treaties

Whether youre an individual investing abroad, an NRI managing Indian income, or a multinational structuring its India operations, our expertise helps you stay ahead of evolving tax laws and compliance needs.

Why Choose Legal-N-Tax Advisory LLP for Tax Treaty Advisory?

As one of the trustedInternational Tax Consultants in India, Legal-N-Tax Advisory LLP stands out for its depth of knowledge and personalized service. Heres why clients across the globe trust us:

1. Expertise in Global Taxation

We specialize in cross-border tax matters, DTAAs, and residency ruleshelping clients avoid common pitfalls and leverage treaty benefits fully.

2. Tailored Solutions

We understand that no two tax cases are the same. Our team provides personalized strategies based on your residency, income source, and treaty conditions.

3. Compliance-Focused

We ensure all documents, filings, and submissions are 100% compliant with Indian and international tax laws, minimizing legal exposure.

4. Comprehensive Support

From obtaining aTax Residency Certificateto tax return preparation and global reporting, we manage everything end-to-end.

5. Client Diversity

We serve:

- NRIs

- Foreign investors

- Startups with international operations

- Global freelancers and consultants

- Foreign companies with Indian branches or subsidiaries

Conclusion

With increasing cross-border income and stricter tax regulations, getting the righttax treaty advisoryis more important than ever. Whether you're a resident of India earning abroad, a foreigner earning in India, or a business operating internationally,Legal-N-Tax Advisory LLPprovides the clarity and confidence you need to manage your global tax responsibilities.

Avoid unnecessary double taxation, ensure timely compliance, and make the most of treaty benefits with expert support from our seasoned tax professionals.

Get in Touch

For personalized guidance onTax Treaty Advisory,Double Taxation Avoidance Agreements, orforeign tax consultancy, connect with our expert team today:

Legal-N-Tax Advisory LLP

Tel:+91-9810957163

Email:info@legalntaxindia.com