Why Outsourced Accounting is the Smart Move for Growing Businesses

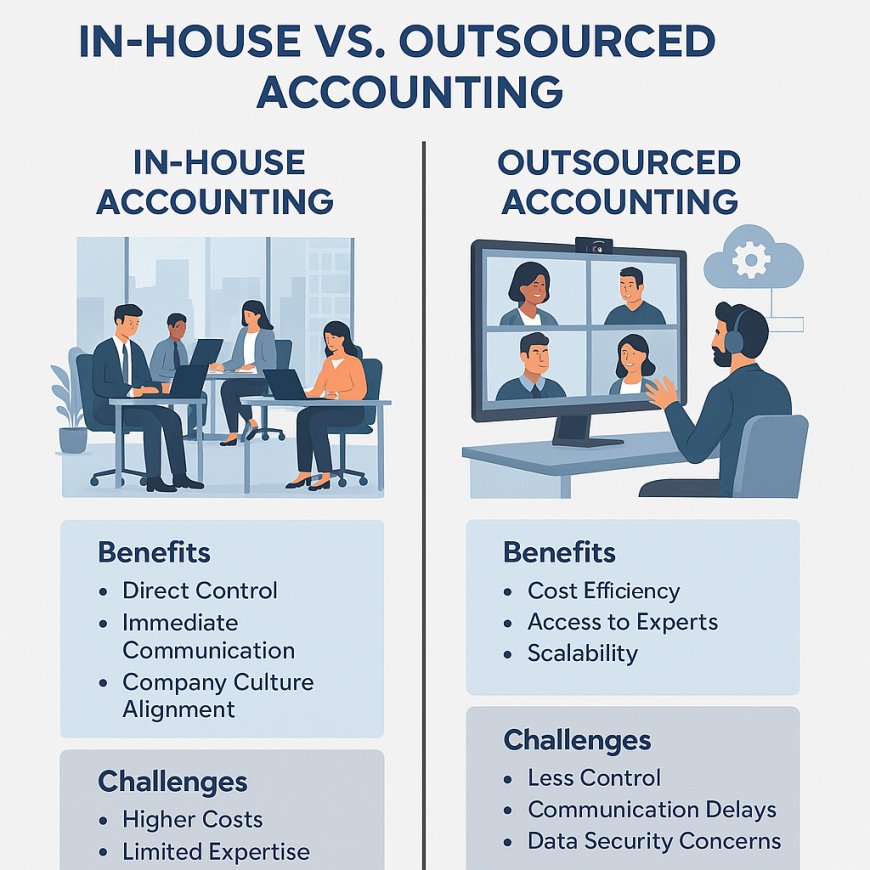

Outsourced accounting services help businesses reduce overhead costs, streamline operations, and gain access to expert financial insights without the burden of managing an in-house team. Learn why outsourcing your accounting could be the best decision for your business growth.

In todays fast-paced business world, financial clarity is critical. Whether youre a startup, SME, or a growing enterprise, keeping your books in order is non-negotiable. Yet, managing accounting in-house can be time-consuming, costly, and riskyespecially when you lack the expertise or resources. This is where outsourced accounting comes in. It offers a reliable, cost-effective solution to maintain financial accuracy and compliance while freeing up internal resources to focus on what matters most: growing your business.

What is Outsourced Accounting?

Outsourced accounting refers to the practice of hiring a third-party service provider to handle all or specific parts of your accounting functions. These services typically include:

-

Bookkeeping

-

Payroll processing

-

Accounts payable and receivable

-

Tax preparation and filing

-

Financial reporting and analysis

-

CFO or controller-level support

The accounting tasks are performed by qualified professionals, often using cloud-based software, allowing business owners to access real-time data anytime, anywhere.

Benefits of Outsourced Accounting

-

Cost Savings

Hiring and training an in-house accounting team is expensive. Outsourcing eliminates recruitment costs, employee benefits, and infrastructure expenses, offering a more affordable alternative. -

Access to Expertise

Outsourcing gives you access to experienced accountants who are up-to-date with the latest tax laws, compliance requirements, and industry standards. -

Scalability

As your business grows, your financial needs evolve. Outsourced accounting services are scalable, allowing you to adjust services as needed without the hassle of restructuring your team. -

Improved Accuracy & Compliance

Mistakes in financial reporting can be costly. Professional outsourced accountants use robust systems and processes to ensure accuracy and compliance. -

Time Efficiency

Focus your time and energy on strategic business activities while the experts handle your numbers. This enhances productivity and allows better decision-making. -

Real-Time Financial Insights

With cloud-based solutions, outsourced accounting provides real-time dashboards and reports that help you make timely, informed business decisions.

Who Should Consider Outsourced Accounting?

-

Startups looking to minimize costs and maximize efficiency

-

Small to mid-sized businesses needing financial expertise without the full-time cost

-

E-commerce businesses with complex transactions and reporting needs

-

Firms expanding internationally that require support with foreign compliance and reporting standards

Common Myths About Outsourcing Accounting

Ill lose control over my finances.

In fact, outsourcing gives you more control with clearer reporting and expert oversight.

Its only for large businesses.

Small businesses benefit the most, gaining access to professional-grade services at a fraction of the cost.

Security is a concern.

Reputable outsourcing firms use encrypted cloud platforms and follow strict data protection regulations.

Final Thoughts

Outsourced accounting is no longer just a cost-cutting measureits a strategic tool that empowers businesses to grow with confidence. From saving time and money to improving financial visibility, the benefits are hard to ignore.

If youre struggling to manage your finances or simply want to focus on scaling your business, outsourcing your accounting may be the smartest move you make this year.